World renowned Italian luxury house Ermenegildo Zegna Group has announced that it has come to a business agreements with Investindustrial Acquisition Corp (IIAC), a special purpose acquisition corporation sponsored by investment subsiadiaries of Investinduatrial VII L.P.

This definitive agreement is expected to make Zegna a public company listed on the New York Stock Exchange later this year. The Zegna family will continue to control the company with a stake of approximately 62%. Based on the transaction value, the merged entity will have an anticipated initial enterprise value of US$3.2 billion with an expected market capitalisation of US$2.5 billion.

“Over 111 years ago, my grandfather and namesake founded Zegna with the belief that caring for both the natural environment and for people was the bedrock for creating the finest textiles and a successful brand,” said Ermenegildo ‘Gildo’ Zegna, CEO of the Zegna Group in a statement. “Today’s announcement underscores the success of our strategy of continuously focusing on the Group’s brand equity while also continuing to build upon our heritage, our ethos of sustainability, and the unique craftsmanship that has made our name synonymous with quality and luxury around the world. The Zegna family will remain at the Company’s helm following the transaction’s completion, and we will continue to invest in creativity, innovation, talent, and technology in order to sustain Zegna’s leadership position in the global luxury market.”

Sergio Ermotti, Chairman of Investindustrial Acquisition Corp., also commented: “Our special purpose acquisition corporation was created for transactions like this one: taking public a well-managed company with strong fundamentals and growth potential like Zegna. Our goal now is to support Zegna in this important new chapter of its history while opening the opportunity to the public to invest in one of the last great iconic independent luxury brands.”

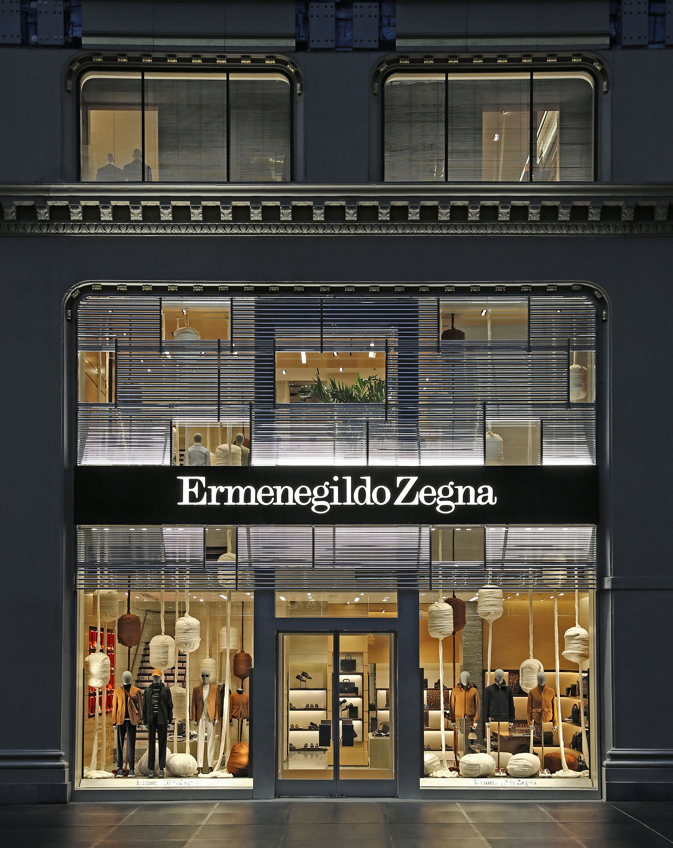

Featured image: Zegna Group