Money doesn’t grow on trees, but that doesn’t mean it can’t grow at all. That’s where investments count, and if done right, they can earn you decent returns without much effort on your part. (Some of us have day jobs and tons of other commitments, after all.)

You may be familiar with traditional fixed deposits, bonds, stocks, unit trusts and the like; but those aren’t the only options available in this digital age where there’s an app for everything. Newer forms of investments such as robo-advisors and peer-to-peer (P2P) financing have emerged over the past decade, giving consumers greater convenience and control over their funds with low barriers to entry.

Known as cash/money management platforms, they provide alternatives for you to diversify your investment portfolio, often at lower management fees and commissions than traditional routes. Here are 7 to check out to start growing your wealth passively today.

StashAway

Founded in Singapore in 2016, StashAway is a digital investment advisory platform (aka robo-advisor) that offers personalised wealth management services. With no minimum deposits required and no lock-in period, users have full discretion on how much they choose to invest while having the freedom to withdraw funds at any time. The funds will be used to buy ETFs (exchange-traded funds) based on a user’s goals and risk index, potentially earning returns of up to 17.6 percent. StashAway charges a management fee of only 0.2% and 0.8% per annum for your investments. W stashaway.com

The StashAway app is available on the App Store, Google Play and Huawei App Gallery.

Funding Societies

Funding Societies is Malaysia’s first and biggest peer-to-peer (P2P) financing platform and is licensed by the Securities Commission Malaysia (SC). It provides funding to SMEs around Southeast Asia from individual and institutional investors, in return for monthly repayments of principal plus interest. A minimum deposit of RM100 is required to earn a projected interest of up to 14 percent per annum. Investment periods are between one to 24 months. W fundingsocieties.com.my

The Funding Societies app is available on the App Store and Google Play.

MYTHEO

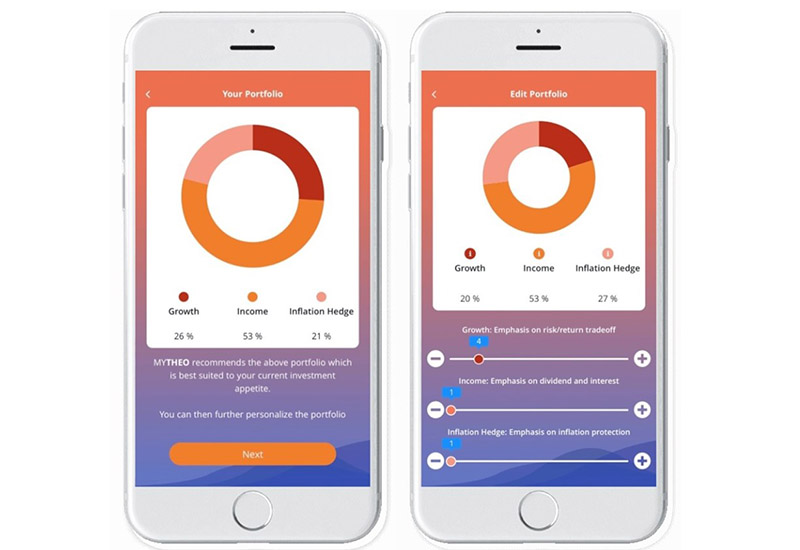

MYHEO is the Malaysian arm of THEO, the first robo-advisory service in Japan. Like StashAway, it relies on algorithms to invest in a mix of ETFs which have exposure to over 10,000 companies from over 86 countries. Investments are allocated into three Functional Portfolios: Growth, Inflation Hedge and Income, each with its own purpose and targeted benefit. This can be automated for you or customised according to your preferences. MYTHEO charges a tiered rate of between 0.5 to 1 percent per annum based on your investment amount, which starts at a minimum deposit of RM100. W mytheo.my

The MYTHEO app is available on the App Store and Google Play.

Wahed Invest

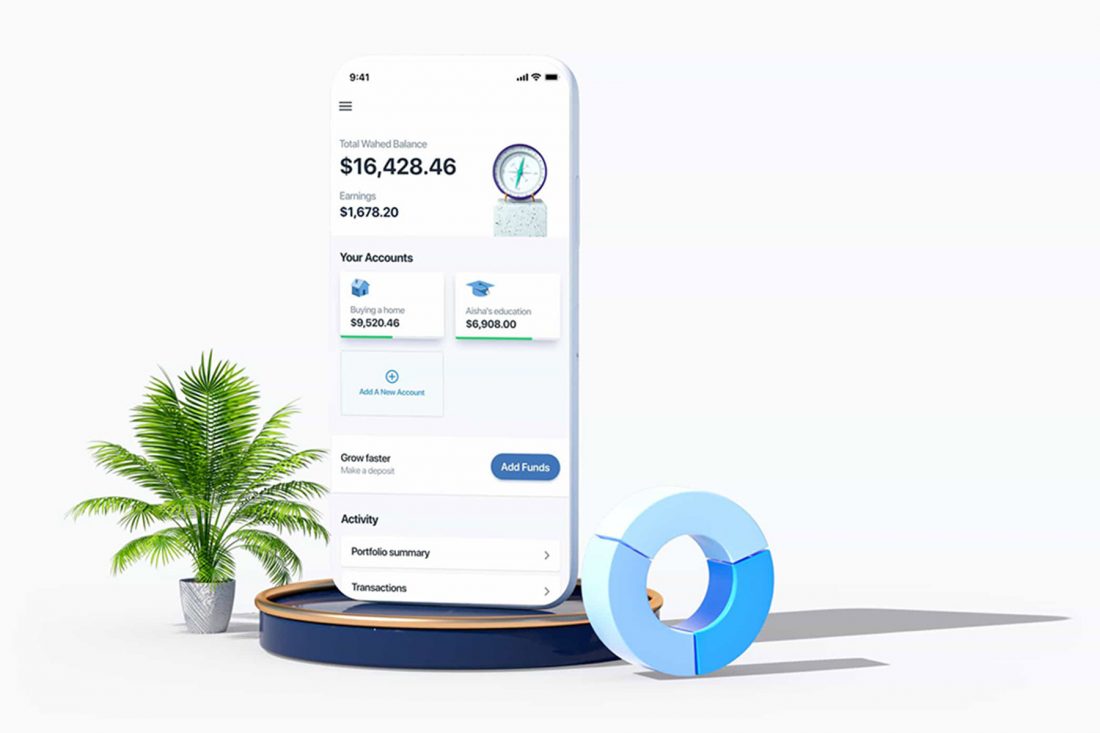

For those concerned about halal investments, there’s New York-based Wahed Invest – the first robo-advisor company to invest in Shariah-compliant securities and sukuks (Islamic bonds). Portfolio types range from very conservative to very aggressive, as well as gold. Deposits start from RM100 with no lock-in period. The company charges either a minimum monthly fee of RM2.50 or an annual fee of 0.39-0.79%, whichever is higher. W wahedinvest.com

The Wahed Invest app is available on the App Store and Google Play.

Versa

Launched in January this year, Versa is the latest locally founded digital cash management app created to help Malaysians unlock the potential of their idle cash. It offers returns on par with fixed deposits (FD), while providing the option to withdraw funds at a day’s notice without penalties. Users may deposit a minimum of RM1 to earn up to 2.4 percent interest per annum. Deposits will go towards investment in the MMF Affin Hwang Enhanced Deposit Fund, with daily interest returns credited in the form of biweekly payouts. W versa.com.my

The Versa app is available on the App Store and Google Play.

BEST Invest

Bank Islam Malaysia’s BEST Invest is also shariah-compliant, but applies both robo-intelligence and big data technology to build an investment portfolio based on your goals. Unlike robo-advisors, the platform allows you to decide which unit trust funds to invest in, then manages the portfolio according to your set preferences. The minimum deposit is RM10 with no lock-in period. Annual management fees range from 0.5 to 1.8 percent, depending on your portfolio. W bestinvest.com

The BEST Invest app is available on the App Store and Google Play.

Fundaztic

Another pioneering P2P lending platform in Malaysia is Fundaztic, which aims to provide access to both financing and investment for businesses and individuals with low entry barriers. Funding amounts range from RM20,000 to RM200,000 with short repayment periods of between 3 months to 36 months and interest rates as low as 8% per annum. Investors can select funds/notes to invest in based on their preferred risk appetite, tenure and interest returns. Fundaztic charges 2% of monthly repayments and 1% of bullet repayments, on top of withdrawal processing fees of up to RM1. W fundaztic.com

Another pioneering P2P lending platform in Malaysia is Fundaztic, which aims to provide access to both financing and investment for businesses and individuals with low entry barriers. Funding amounts range from RM20,000 to RM200,000 with short repayment periods of between 3 months to 36 months and interest rates as low as 8% per annum. Investors can select funds/notes to invest in based on their preferred risk appetite, tenure and interest returns. Fundaztic charges 2% of monthly repayments and 1% of bullet repayments, on top of withdrawal processing fees of up to RM1. W fundaztic.com

The Fundaztic app is available on the App Store and Google Play.