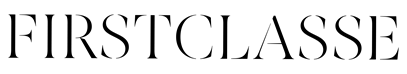

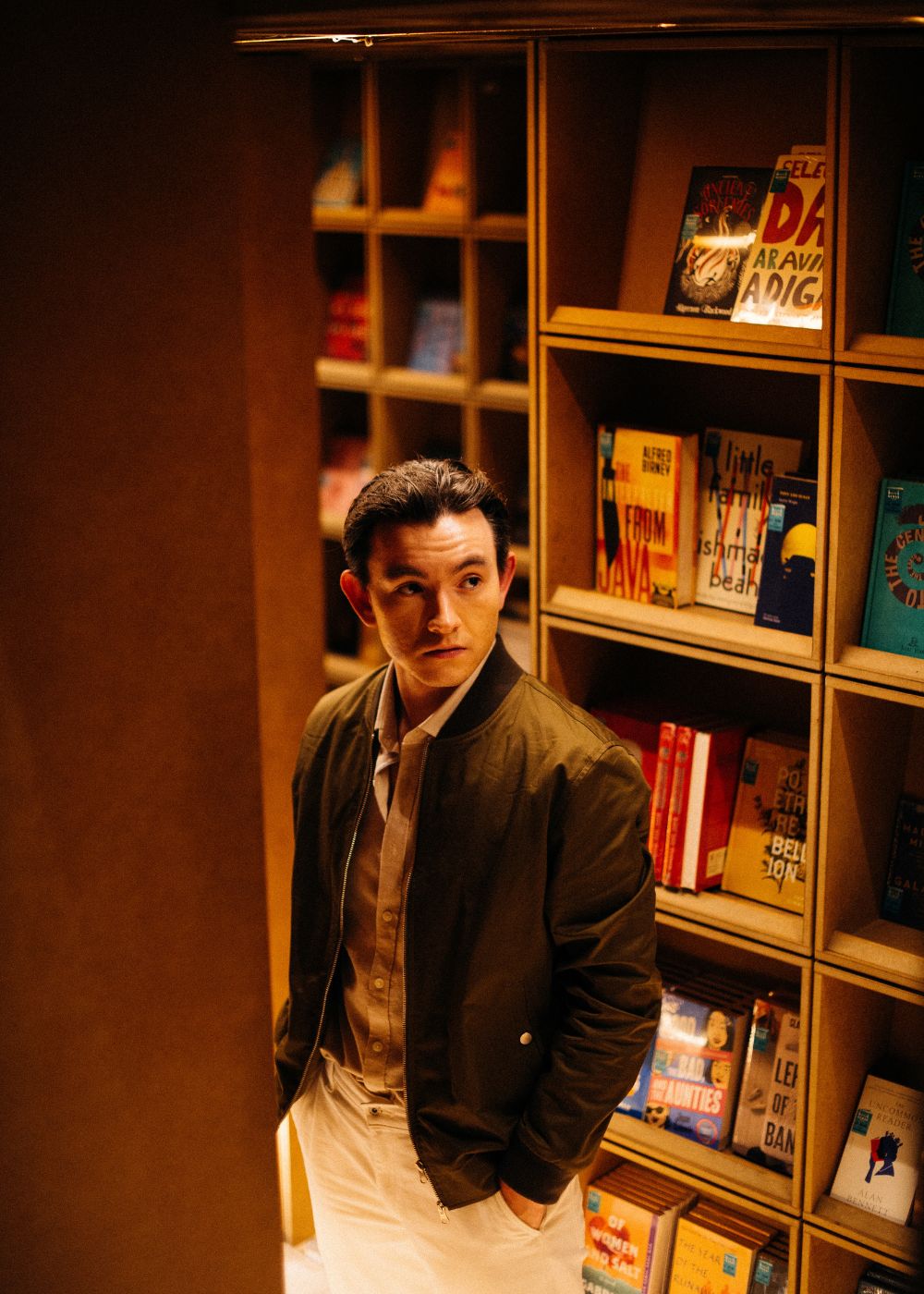

At just 26, Richard Armstrong has already achieved what many in venture capital spend decades chasing: a seat at the partner table. As a partner at TA Ventures (TAV), a global early-stage venture firm behind 16 unicorns and six IPOs, he currently leads the firm’s global operations, but primarily focuses on Asia.

“I knew from a young age that I wanted to be my own boss, not follow the traditional 9-to-5,” he says. The Bangkok-based investor, who once studied international relations and thought of becoming an ambassador, was ultimately drawn to the venture capital industry.

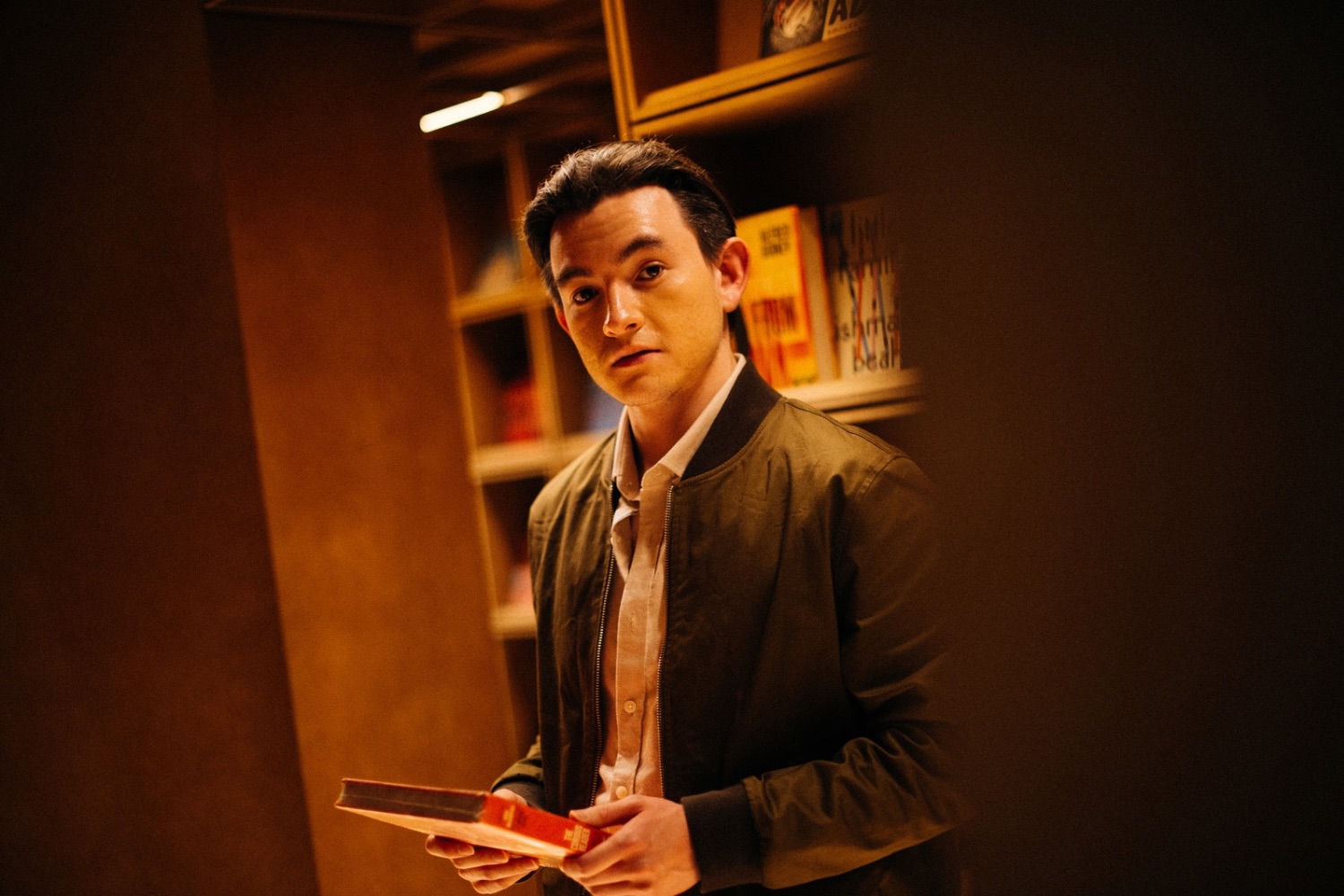

For Richard, venture capital isn’t just a job; it’s a mission. “My primary job is to meet interesting founders – the smartest people working on the most ambitious projects,” he says. From making healthcare more accessible to bringing basic financial services to underserved communities, Richard invests in ideas with real-world impact. But beyond spotting potential unicorns, his work is about shaping ecosystems, mentoring talent, and creating opportunities where few exist.

His approach reflects his own upbringing, one marked by international exposure, independence, and adaptability. Having attended ten schools across six countries, Richard describes himself as “a square peg in a round hole” from a young age. Boarding school and early entrepreneurial endeavours taught him to be self-reliant, to measure ROI in life, and to prioritise purpose over convention.

Family also played a key role in shaping his mindset. His father instilled in him an entrepreneurial approach to money and problem-solving, while his sister, public figure Becky Armstrong, provided unwavering support and guidance. “My sister has always been super supportive. We help each other across fields – she’s more on media, I’m more on tech – but there’s a lot of overlap,” he explains. These influences helped cultivate a growth mindset that Richard now applies to every investment decision.

Richard’s journey into venture capital didn’t follow the typical pipeline through Harvard, Oxford, or investment banking. Instead, he carved his own path, leveraging personal investments, entrepreneurial projects, and mentorship from global industry leaders. By proving his value early, he accelerated into a partner role faster than most, now steering TAV’s strategy across one of the world’s most dynamic regions.

Investing in people and passion

Richard’s approach to founders is refreshingly human. He isn’t focused on Ivy League credentials or flashy résumés. “I don’t need the smartest person. I need the one who’s most passionate and hardworking,” he says. Instead, what matters most is the founder’s mission – their “why.” This intrinsic drive, he explains, often outweighs experience or industry knowledge.

For him, purpose also reveals itself in the founders’ drive. How did they land their first client? How did they overcome obstacles? These small signals often indicate the resilience needed to thrive in highly regulated and competitive markets, particularly across Southeast Asia.

Richard also divides founders into two categories. First-time founders bring a refreshing naivety that allows them to challenge highly regulated industries. Second-time founders offer deep expertise in a vertical, which becomes critical when solving complex problems. But regardless of category, the measure of success lies in perseverance, resourcefulness, and adaptability.

“Why are they building this?” Richard asks founders repeatedly. “How did they get their first client? How do they navigate challenges? I invest in the founders’ why, not just their solution.” For Richard, talent is about grit as much as it is about intelligence.

At the same time, he cautions against common pitfalls in pitching: focusing too much on the solution rather than the purpose. “Many startups talk about what they’re building and how many customers they’ll have, but they forget why. Why them, why now, why their approach wins – that’s crucial.”

Balancing risk and reward

Venture capital is inherently risky, and Richard embraces that uncertainty with a clear-eyed strategy. Reviewing over 10,000 companies in just a few years, he emphasises pattern recognition and structured screening to identify potential winners.

His approach divides investments between more predictable returns and ‘moonshots’ that could redefine industries. A moonshot is a high-risk, high-reward bet – an idea that may seem improbable today but, if successful, could transform entire industries or even society.

“For moonshots, you don’t focus on why it might fail – there are a thousand reasons. You focus on, if it succeeds, how big can this be? Can it change society?” Richard explains. This philosophy is particularly relevant in Southeast Asia, where the venture ecosystem remains nascent. With only 20–30 early stage VCs across 700 million people, opportunity abounds for bold, visionary founders.

Even during market downturns, Richard sees possibility. “Downturns mean less competition, but quality founders still need capital,” he says. His current focus is on AI infrastructure, the “picks and shovels” of the technology world, which provide foundational tools for future innovation. He warns against following hype blindly, instead advocating for investments that solve deep problems with real-world impact.

Richard also emphasises mentorship, both as a recipient and as a guide. Drawing from multiple mentors across industries, he gains insights in fintech, healthcare, e-commerce, and AI. In turn, he gives back, mentoring students at Thailand’s Sasin Business School and aspiring venture professionals across the region. “A lot of people opened doors for me at a young age,” he says. “If I can do the same for others, I’ll be happy to.”

Building bold futures in Asia and beyond

Richard’s vision extends beyond individual companies to the ecosystem at large. He sees Southeast Asia as a region on the cusp of its next wave of innovation. While U.S. and European founders have had decades of market experience, Richard believes Asia’s smart, hardworking, and undercapitalised founders are poised to follow suit.“People say Asia is done. I don’t think so. It’s still very early,” he says.

At the heart of Richard’s philosophy is a mindset of relentless learning and ambition. “I never lose. Either I win or I learn,” he says. Whether it’s meeting 15–20 founders a week or mentoring the next generation, he remains driven by curiosity and purpose.

His advice to aspiring founders is simple yet profound: be bold, be ambitious, and build with purpose. Because whether you succeed immediately or stumble along the way, the experience positions you ahead of those who never take the leap.

Richard Armstrong’s story is a reminder that success in venture capital – and in life – is rarely linear. It’s defined by vision, courage, and the willingness to bet on people and ideas that can change the world. For founders, entrepreneurs, and startup-curious readers, his journey offers both inspiration and a roadmap: pursue your passion, embrace uncertainty, and never lose sight of the why.

Discover more inspiring people stories here.

Photography by Imran Sulaiman

Richard wears his own jacket and shirt from Royal Ivy Regatta.